February 14, 2025

What is Mean Reversion, and How Can Investors Use It?

Table of contents

Introduction

As you will no doubt be aware, the fields of statistics and investing are closely intertwined. After all, stock market history is a century long dataset with opening and closing prices of assets on which we can perform statistical analyses.

People have tried for decades to assign statistical models to datasets from the stock market and use these to forecast forwards, with limited success. There are, however, some concepts that persist beyond the notions of predicting stock market performance to make money. One of these is reversion to the mean.

Reversion to the Mean

So what is reversion to the mean? It's a common statistics term often banded around both in day-to-day life and with respect to investment performance but few understand what it means.

In essence, reversion to the mean is the tendency for a variable that has been observed to differ from its average value to eventually return to that average value.

This phenomenon can be seen in many aspects of life, including investment performance. In this blog post, we will discuss reversion to the mean and how it affects investment returns. We will also provide some tips on how you can take advantage of this phenomenon in order to improve your investment portfolio!

What is reversion to the mean and why should you care about it

Human beings are often guilty of over-reacting to short-term changes. This can be seen in our daily lives when we make decisions based on recent events that may not be representative of the long-term trend. For example, you may go on a diet and lose a significant amount of weight in the first month.

Your friends and family may start to compliment you on your weight loss and you feel great about yourself! However, this short-term change is not likely to be representative of the long-term trend.

In other words, it is unlikely that you will continue to lose weight at the same rate in the second month or even maintain your weight loss.

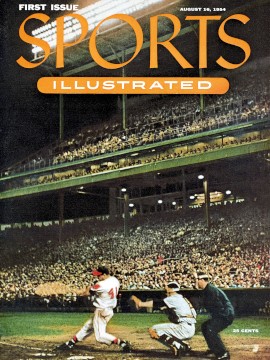

The Sports Illustrated Paradox

This tendency to over-react to short-term changes is also seen in the stock market. In fact, there is a famous phenomenon known as the "Sports Illustrated Paradox" which demonstrates this concept perfectly.

The Sports Illustrated Paradox states that a player / team that is featured on the cover of Sports Illustrated magazine is likely to have worse performance in the following season. Wait, what do you mean worse?

The period following a season of outperformance

That's right: this is because the team has been "blessed" with good fortune and people tend to over-react to this short-term event. Making the cover of Sports Illustrated usually requires a season of extraordinary performance, likely beyond what is expected of a player / team.

As a result, one might bet on the team expecting that the run of good form will continue. However, this is usually not the case and the team's performance reverts back to the mean the following season.

How reversion to the mean affects investment performance

The same can be said for investment performance. Just because a stock has had a great year does not mean that it will continue to outperform in the following year. In fact, reversion to the mean would suggest that the stock is likely to underperform!

Fundamendal Analysis

Of course, this is purely from a statistical standpoint and ignores the fact that stock prices are (sometimes) based on fundamentals too. However, what it does do is highlight the importance of understanding basic statistical concepts and how they might affect your portfolio.

For example, when a stock or fund outperforms the market in the short-term, investors tend to pour money into it in the hope of earning above-average returns. However, reversion to the mean suggests that this is not likely to be sustainable in the long run. You of course want to be making investments before their big run ups rather than afterwards.

Blue Chip Companies

That being said, the best companies continue to grow strongly for decades, so it's vitally important to distinguish between periods of outperformance in stocks that have historically been undervalued with respect to future potential, and those that experience secular growth by virtue of just simply being better than everyone else.

Or, you know, having a Facebook-esque monopoly.

Tips on how to take advantage of reversion to the mean in your investment portfolio

Investors need to be aware of this phenomenon in order to avoid making costly mistakes. Here are a few tips on how you can take advantage of reversion to the mean in your investment portfolio:

- Don't chase performance: When a stock or fund outperforms the market in the short-term, resist the urge to pour money into it. Chasing performance is a surefire way to lose money in the long run. As mentioned, decide if your urge to do so stems from long term belief in the company or a hunt for short term gains.

- Be patient: Many investors are impatient and want to see immediate results from their investments. However, reversion to the mean suggests that it takes time for investment performance to revert back to the average. Think trends not swings!

- Stay diversified: Diversification is key to any successful investment portfolio. By spreading your money across different asset classes, you can minimise the impact of reversion to the mean. As different individual securities wax and wane in performance, the effects of short term fluctuations may well balance each other out.

Conclusion

The bottom line is that reversion to the mean can be a powerful tool for improving your investment performance.

By understanding and taking advantage of this phenomenon, you can improve your chances of achieving success in the stock market! Of course, keen portfolio management requires a detailed analytical tool with real time updates and insights on all your holdings.

Which is handy, because that's exactly what we've built. You can find a signup link for the Strabo portfolio tracker at the foot of the page.

This is one more example of how a basic understanding of statistics puts one ahead when thinking about not just investing but how real world events occur and interact with one another. There is a great deal of literature on the subject and smarter minds than ours have distilled this into more interesting and simpler summaries. We particularly like Taleb's Black Swan Theory and How Not to Be Wrong by James O'Brien.

What statistical concepts do you apply to your own portfolio management?

Check it out today

Further reading

Company Updates

May 16, 2022

Why We're Crowdfunding

Read more about our decision to launch a Crowdfund with Seedrs

Investing

May 2, 2023

What is the Best Crypto Portfolio Tracker

Discover how to use Strabo and other tools to track your crypto portfolio across platforms

Investing

November 19, 2024

Why is there a Crypto Surge and What Does it Mean for my Portfolio

With crypto prices rising across the board, let's take a look at what this means for your portfolio