June 27, 2022

Investing in Hated Sectors: Do Sin Stocks Outperform Others?

Table of contents

Introduction

When most people think about sin stocks, they think of companies that produce products or services that are frowned upon by society. Alcohol, tobacco, and firearms are all classic examples of sin stocks. But what many people don't know is that there is a whole category of sin stocks known as "anti-ESG" stocks. ESG stands for environmental, social, and governance, and refers to the growing movement among investors to consider the social and environmental impact of their investments. Anti-ESG investing is when you invest in companies that have negative ESG ratings. Do sin stocks outperform other types of stocks? Let's take a look!

Now it's important to preface this by saying that we are proponents of impact finance: it's just interesting to take a look at different corners of the investing community and put them under the spotlight.

What are sin stocks and anti-ESG stocks?

As the name suggests, sin stocks are those related to products or services which are related to unethical or immoral activities, often those which exploit human vices or weaknesses.

Of course, this is a subjective measure but some examples include gambling, tobacco, alcohol, defence, cannabis and adult entertainment. By virtue of the nature of these products, they are often defensive, recession proof stocks: a market drawback likely isn't going to stop most people smoking! They can also be counter-cyclical: difficult times often push people to increase consumption of drugs, gambling and drinking.

Do sin stocks outperform other types of stocks?

The most well known and easily trackable benchmark of "sinful performance" is the Vice Fund.

Although sin funds existed before, the term was an informal one used to represent funds which invested the majority of their capital into sinful stocks. So how well has it done?

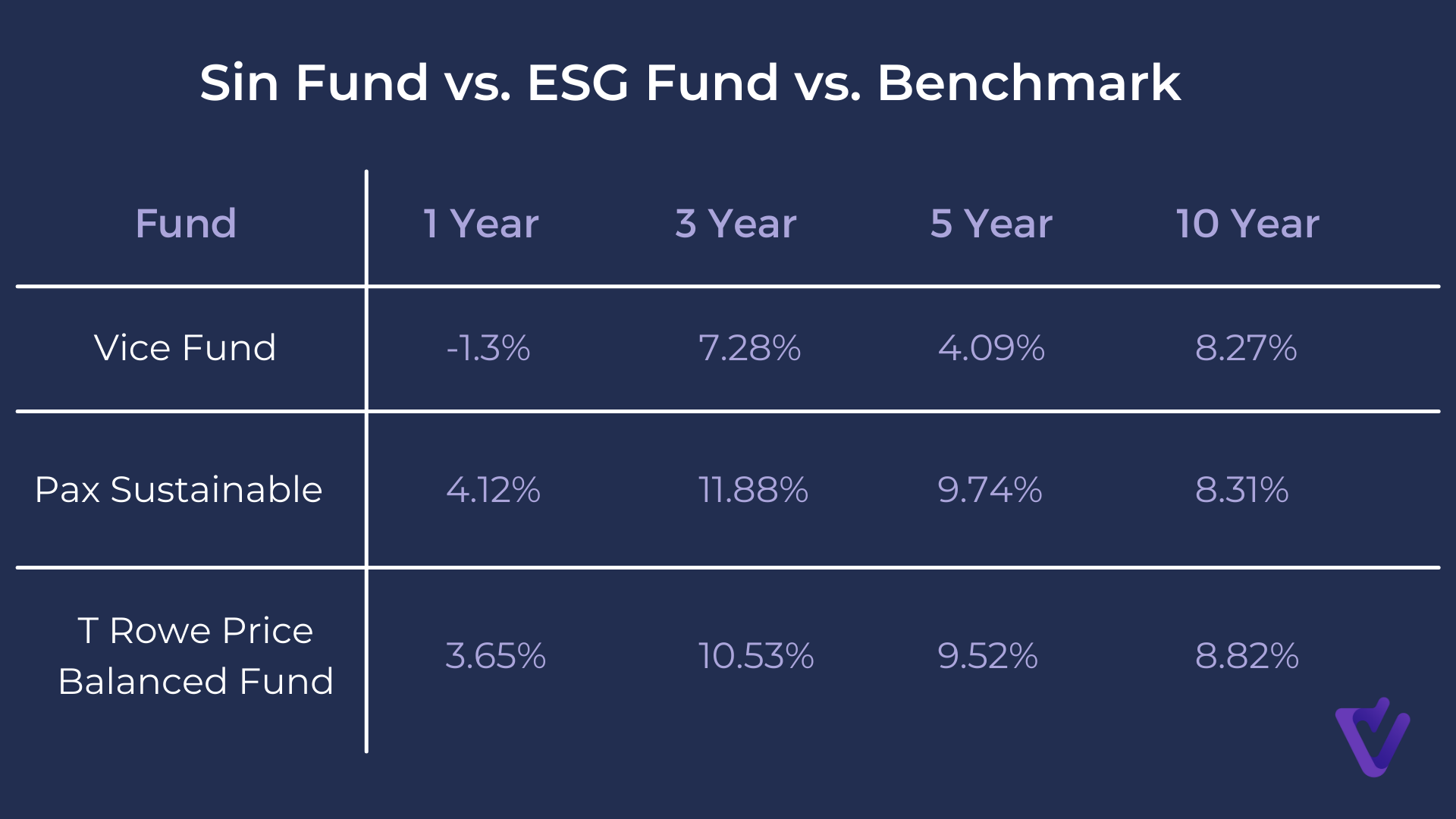

A number of comparative studies have been done, but the most telling way is to compare the Vice Fund to both a comparable benchmark index fund, and an ESG fund, here the Pax Sustainable Allocation Fund. Although performance is correlated, representing a wider correlation to market conditions, the sin fund still fell short of the benchmark by every metric. It also notably fell short of the T Rowe Price market index. However, it is worth noting that the last decade has seen huge outperformance in tech stocks, which make up a considerable proportion of both major indices and impact funds, who are often heavily weighted towards tech, healthcare and fintech.

It's probably also worth noting that general public sentiment has shifted massively over the past few decades - as well as the prevalence towards climate positive tech, there has also been an increase in healthcare transparency and more stringent regulation which has dampened the growth of typical sin stocks.

Why do some people invest in sin stocks?

If these stocks are looked down on by the rest of the market, it begs the question: why would you want to invest in them? Well, that's exactly the reason they may be of interest. Securities that are ignored by the majority of the market for reasons that are not related to the fundamentals of the business will see a depressed valuation in relation to the long-term prospects of the business. Or, in simple terms, they'll be undervalued.

Now, this doesn't speak to the moral implications of investing in businesses that are pernicious to society, but that's not the point. Where there is potential, the capital will flow. But do sin stocks outperform others? Well, that's a different question entirely.

What are the risks associated with investing in sin stocks?

There are a couple of interesting perspectives on the risks of hated sectors. Sin stocks have the potential to be volatile and risky investments. For example, tobacco companies are often the target of lawsuits, which can lead to large financial settlements. Alcohol companies are also subject to regulations that can change at any time, which can impact their bottom line. And firearm companies are usually reliant on a small number of customers, which can make them susceptible to fluctuations in demand. So, while sin stocks may offer the potential for above-average returns, they also come with above-average risks.

The long term future of these sorts of products is also never guaranteed. While they exhibit very low price elasticity of demand in the short term, you never really know how long they will be around: tobacco companies are constantly evading regulators and the competition of vaping products, and oil companies are being forced to innovate or pivot their way out of the shadow of renewable energy, to name just two.

How can you research whether a company is a sin stock?

It's usually pretty simple to figure out! There are sin stock indices and mutual funds, should you need further clarification, but usually common sense is a strong guide to working out how good or bad a company may be. Finding a hated sector is the easy part! A cursory glance at most financial publications is a good place to start - FT, Motley Fool, Morning Brew and more. Large publications are motivated to discuss the most exciting topics, and news is often negative leaning. Thus, they end up covering situations at their worst, often with perpetrators (who might be publicly traded!).

Conclusion

Is it better to be bad than to be good? It's an existential question and one to which we won't try to proffer an answer. However, if your moral or religious boundaries preclude you from investing in sin stocks, the decision has been made already! If not, the underperformance over the past decade makes it a less convincing proposition, but the defensive and even counter-cyclical nature of sin stocks in hated sectors will likely become more apparent in slightly more turbulent market conditions. Either way, you will want to monitor both portfolio allocation and individual stock and fund performance over the long term. Both of these can be done, along with the necessary rebalancing, on the Strabo dashboard. Sign up below and start managing your portfolio today!

Check it out today

Further reading

Company Updates

May 16, 2022

Why We're Crowdfunding

Read more about our decision to launch a Crowdfund with Seedrs

Investing

May 2, 2023

What is the Best Crypto Portfolio Tracker

Discover how to use Strabo and other tools to track your crypto portfolio across platforms

Investing

November 19, 2024

Why is there a Crypto Surge and What Does it Mean for my Portfolio

With crypto prices rising across the board, let's take a look at what this means for your portfolio